Residual Price versus Lease End Buyout

The next biggest negotiable term after your Capitalized Cost in your lease is Residual Price of the vehicle. The Residual Price is the expected value of the car at the end of the lease. The main purpose of this value is to determine how much the vehicle will depreciate over the period of lease. The Residual Value is determined so that you can ascertain how much you owe while you are making payments.

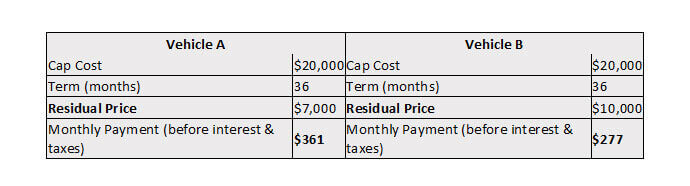

Here is an example of the same car with two different payment plans based on nothing other than the residual price difference.

In this example, you can see that the monthly payment for vehicle A is over 26% or higher than the payment for the vehicle B. the only difference between the two is their Residual Price.

Usually, the residual prices are not determined by the car dealers. These values are calculated by the banks and financial institutions. Banks calculate these numbers through different statistics and reports on the values of vehicles when they are returned from leases. Companies like ALG (Automated Lease Guide) provide these values to dealers and banks that use these figures as reference points for designing lease agreements.

As is the case with other terms, if you work directly with a leasing company you have more leverage in bargaining your Residual Price. It means that dealer will try to earn revenue through this. A dealer will rarely present you with lower or higher residual price options on your vehicle.

For most of the people, choosing the highest residual price is of no importance as they think that they simply have to turn in the vehicle to the leasing company at the end of their lease. It is at this point actually that the bank has to negotiate and content with the higher or lower value of the vehicle.

For those who are looking to buy the leased vehicle at the end of their lease term, negotiating a lower residual value may sound more affordable. But in reality, the consumer is just paying the difference during the term of the lease instead at the end of the lease. The amount of money involved is the same, the only difference is in the time period.

Our general recommendation would be to find the highest possible residual price of your vehicle. Again, some lenders may change their residual price to benefit themselves. Among lenders, captive leasing companies (Leasing companies owned or operated by automotive manufacturers) are most likely to do this in order to increase the sales of their vehicles. They can afford to create higher residuals because they have the benefit of making more money on the sale of the vehicle. Independent leasing companies (those not owned by a manufacturer) do not make money on the sale of the vehicle. Therefore, they need to be more careful about setting higher residual values of the vehicles.

Due to a higher residual value, you will have to pay higher as a result of the higher lease-end buyout price. For this, reason we recommend a higher residual because you may or may not buy the vehicle at the end of the term, but you will certainly make the payments during the term. A higher residual value gives you more leverage during the term of the lease.